Anchor Protocol: The Best Savings Account in Crypto

Jan 27, 2022

As LUNA surpasses Binance Smart Chain to become the 2nd largest chain by TVL, the Terra ecosystem has gained significant traction in 2021. In particular, its premier DeFi app Anchor Protocol accounts for about half of all the TVL in the Terra ecosystem. This simple yet powerful DeFi app currently has $10.5b in TVL and features one of the best stablecoin yields in crypto at about a 19.5% APY. Let’s look at the main features of this protocol, how it works, how it compares to other DeFi protocols, the ANC token, and we’ll finish off by going over its sustainability.

What is Anchor Protocol?

Anchor is a DeFi app on the Terra ecosystem that allows users to earn yield on their UST stablecoins, take out UST loans using collateralized assets, and provide liquidity for the ANC-UST Terraswap pair. Anchor’s main product ‘Earn’ allows users to earn a steady 19.5% APY yield on UST deposits. It’s one of the best stablecoin yields in crypto, given how easy it is to use.

Summary of Anchor

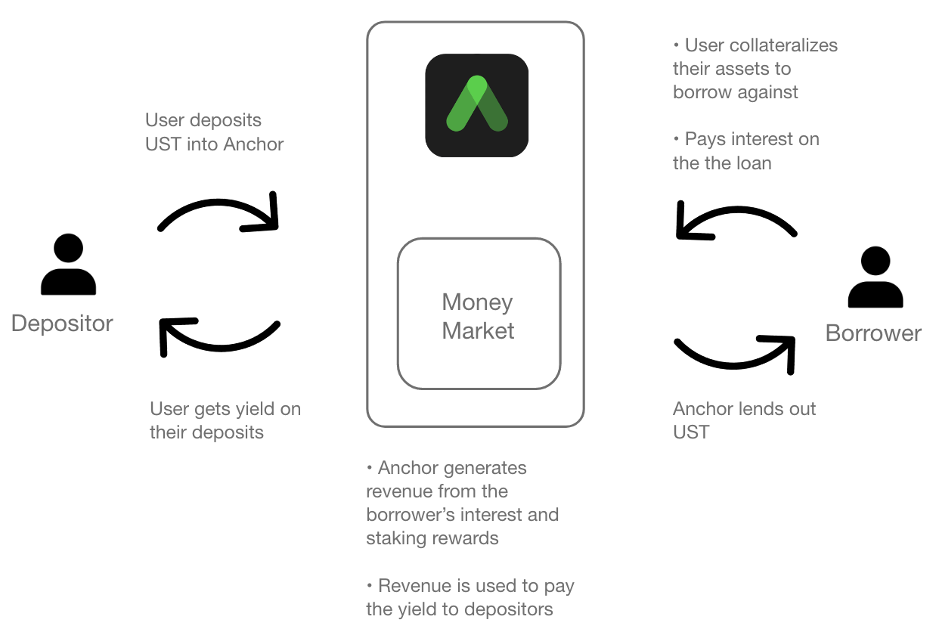

Anchor Protocol is built by Terraform Labs and launched on Terra’s mainnet in March 2021. The backbone of the protocol is the Terra money market - a smart contract on the Terra blockchain that facilitates the borrowing and lending of stablecoins in a trustless and permissionless manner. The protocol pays out yield to depositors and lends out UST to borrowers who provide collateral with no third party involved.

Borrowers that are looking to take out a loan on their assets can do so by collateralizing ETH or LUNA (and soon SOL and ATOM). They can do so by bonding their assets by converting them into bEHT or bLUNA. This allows the protocol to earn the block rewards of the underlying asset and makes them fundable and transferable.

Users can provide liquidity in the ANC-UST Terraswap Pair to get an APR of about 60% (at the time of this writing). Holders of the ANC token can stake it on the protocol to earn about a 19% APR. The yield comes from protocol fees that are distributed to ANC stakers to incentivize governance participation and decrease circulating ANC supply.

How is the yield generated?

The team behind Anchor set out a goal to offer a stable interest rate. This interest rate, known as the Anchor Rate, is the target rate that Anchor aims to offer its depositors from the revenue it collects. Currently, the Anchor Rate is determined by governance votes, but the team plans to transition the Anchor Rate to a more algorithmic approach.

The 19.5% APY that’s paid to depositors comes from two sources – borrower’s interest and the yield from collateralized assets. When a user deposits UST on Anchor, their deposit is pooled into the Anchor money market and lent out when a borrower wants to take out a loan. To take out a loan, a borrower has to provide collateral to take a loan against. When the loan is paid back, the borrower must also pay the interest for borrowing UST. Anchor receives revenue from the yield of the collateralized assets and the borrower’s interest.

The borrower’s interest rate is determined by an interest rate algorithm based on borrowing demand and supply. A key input to the algorithm is the Terra pool utilization ratio, which represents the fraction of Terra in the pool that is borrowed. When the utilization ratio is high, the algorithm charges more interest to the borrowers and pays more to the depositors. Inversely, when the utilization ratio is low, the algorithm charges less interest to the borrowers and pays less to the depositors. This is meant to incentivize borrowing when the borrowing demand is low (lower borrowing interest) and disincentivize borrowing when the borrowing demand is high (higher borrowing interest).

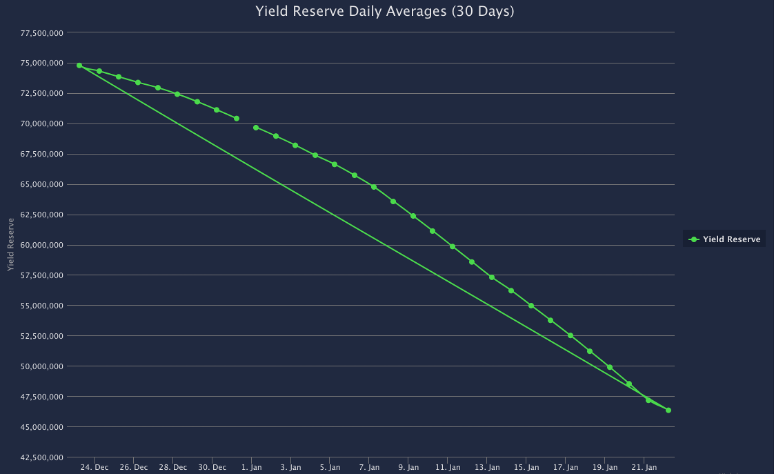

Since the revenue can fluctuate depending on the demand of borrowers, Anchor has another mechanism to maintain the stability of the Anchor Rate, known as the ‘yield reserve’. The yield generated from the collateralized assets is paid to the depositors, but when the yield of those assets is greater than the Anchor Rate, the excess yield is put in the yield reserve. And when the yield from those assets is less than the Anchor Rate, the difference will come from the yield reserve until it is depleted.

Anchor’s Principal Protection

To ensure that all deposits are safe, Anchor has a liquidation mechanism to make sure loans don’t end up defaulting. Liquidators monitor risky loans and can submit a bid to the Liquidation Contract, offering to purchase the liquidated collateral in exchange for UST. For example, suppose Bob takes out a loan of 2000 UST and puts down $6000 worth of collateral, giving him a LTV ratio of 33%. If the value of his collateral drops below $4000, that would exceed a LTV of 50%, deeming the loan risky. His loan will be partially liquidated to ensure that the loan remains over-collateralized and therefore keeps the deposits safe.

Some important notes on Anchor’s Principal Protection:

- Only loans with a total collateral value of above 2,000 UST are partially liquidated. Loans with a total collateral value of under 2,000 UST are fully liquidated.

- Anchor uses an oracle to provide a price feed for the collateralized assets.

- Users can participate in the liquidations on the kujira protocol.

How does Anchor compare to other DeFi protocols?

In terms of the protocol mechanisms, Anchor takes a lot of similarities to other DeFi protocols such as Compound or Aave. All three of these protocols have a money market where depositors can earn yield and borrowers can take out loans. But unlike Anchor, Compound and Aave offer variable APY yield based on the ratio of depositors and borrowers, which can fluctuate dramatically. This is because borrowers can collateralize assets that don’t generate block rewards, such as stablecoins or bitcoin. On Anchor, borrowers can only collateralize assets from major proof-of-stake blockchains take produce block rewards.

Anchor’s token and tokenomics

ANC is the governance token for the Anchor protocol. It is used to create and vote on governance proposals, earn protocol fees from staking, and distributed to borrowers as incentives.

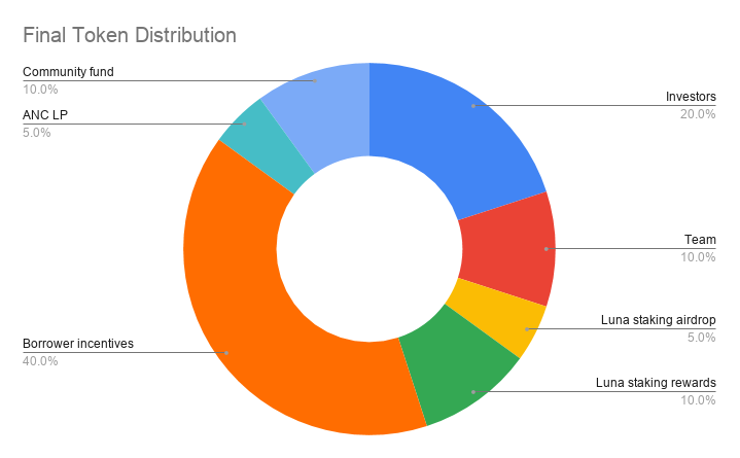

The ANC token distribution is shown below along with the vesting schedule. Investors get 20% of the supply with a 6-month lockup period, following a 1-year linear vesting schedule. The team will get a 10% allocation with a 4-year vesting period, with the tokens releasing every end-of-year. 55% of the supply is used as rewards for being a participant in the Terra ecosystem by borrowing on Anchor (40%), staking LUNA (10%), or from a free airdrop to early LUNA stakers (5%).

According to Coingecko, ANC has a market cap of $441,893,101 and a fully diluted valuation (FDV) of $2,124,377,021. Anchor’s FDV is valued similarly to other borrowing/lending DeFi apps such as Aave and Compound ($2,260,517,720 and $1,209,425,315 respectively). Based on the vesting schedule, 475 million tokens will be unlocked in the first year, which is almost 50% of the total supply of 1 billion tokens. The tokenomics are designed with the idea of incentivizing borrowers to take out loans by paying them to do so. This will attract more collateralize assets and help bring stability to the depositor/borrower ratio. Anchor has a buyback program that uses the fees that it collected to buy back ANC tokens and distributes those tokens back to users of the protocol.

ANC TLV, DeFi Llama

Is Anchor’s ~20% APY sustainable?

At a high level, the revenue from the borrowers is used to pay the yield to the depositors. The money coming into the protocol has to be more than the money going out. Initially, Anchor settled on an arbitrary number (20%) for the Anchor Rate but will transition into a weighted average of the yields earned from the collateralized assets, aspiring to be DeFi’s benchmark interest rate. At launch, 20% APY was possible since LUNA’s staking reward offered a 12% APY and at a TLV of 50%, which effectively generates a 24% APY for every UST lent out. This is assuming every dollar deposited is lent out to a borrower collateralizing LUNA at a 2:1 ratio and LUNA staking must yield a 12% APY. It’s an ambitious assumption to make – fast forward to today – LUNA’s staking yield is 7.8% APY and the current depositor/borrower ratio is 4.15, meaning the amount deposited is outpacing the amount being borrowed. Currently, the protocol’s revenue is generating $522,587,293. The expense of paying the yield to depositors is $1,053,060,934. Which leads to a deficit of $530,473,641. The protocol currently brings in about half of the revenue that is needed to pay the 19.5% APY to depositors. Given its current balance sheet, a more sustainable APY is closer to 9-10%.

As mentioned before, Anchor is working on adding more collateralized assets such as SOL, ATOM, and DOT. Given that these assets are close to a combined 60 billion market cap, capturing a small percentage as collateral can help increase its revenue. If 3 billion dollars of new assets are deposited and assuming they generate a 6% APR, that adds 180 million dollars in revenue. Additionally, since most of UST deposited is not lent out to borrowers, and therefore remains underutilized, they can put that capital to work in other protocols to generate some extra yield. As the Anchor Rate transitions to a floating rate, it will realistically reflect the yield paid to depositors based on the revenue it receives from collateralized assets. With the addition of new assets along with borrowing interest, Anchor could offer something closer to 15% APY and be sustainable in the long term.

Having an Anchor Rate that closely follows the revenue it generates will also help the yield reserve become long-term sustainable. The yield reserve has been helping the Anchor Rate remain stable, but it has been consistently depleting since December 2021. The reserve had about 75 million dollars in Summer 2021, of which $70 million was injected from Terra Form Labs to subsidize the yield while they integrate new collaterals. The yield reserve currently has about 46 million, and at this rate, it will probably run out in less than 100 days. Given the rapid growth in TVL, the reserve will continue to go down until it is depleted.

Anchor's yield reserve, source

Final Words

In a recent twitter thread, Do Kwon addresses Anchor’s depleting yield reserve as many in the community are concerned as to what happens when it hits zero. He mentions the yield reserve is working exactly as intended – borrowing hasn’t kept up with the deposits and the yield reserve is making up for the shortfall. When the yield reserve runs out, Anchor will simply operate like a regular money market like Aave or Compound. But can still provide a higher and more stable interest rate than the other DeFi protocols based on the predicable staking rewards along with borrower’s interest. They are still working on integrating more assets that can be collateralized but they are racing against time. He finishes the thread by saying he is working on subsidizing the yield reserve as a short-term measure to maintain the growth of the network. Anchor is still in its beginning stage and this subsidy will help grow the network as they work on making it long-term sustainable.

Resources:

- Anchor Protocol Docs

- Anchor's Whitepaper

- https://agora.terra.money/t/bolstering-anchors-sustainability/1516

- https://wantfi.com/terra-luna-anchor-protocol-savings-account.html

- https://medium.com/coinmonks/forget-banks-earn-20-fixed-income-on-your-savings-in-anchor-protocol-d0f4833c901f